Waste and Abuse! Tahoma Finance Director Incurs $1.5 Million in IRS Fines. Retaliates Against Whistleblower.

In a case of self-admitted negligence and apathy over a period of several years, the current Tahoma School District (TSD) Director of Finance/Assistant Superintendent appears to have incurred $1.5M in IRS fines against the TSD. Moreover, after an independent investigation was conducted that documented the extent of her involvement, those who filed complaints or asked for transparency regarding the issue were retaliated against and repeatedly silenced.

As parents, we trust that when we send our kids off to school, they will be cared for and educated. Most of us don’t have a degree in education and so we trust our education professionals. When we take our kids to the doctor, we trust the treatment plans they give us. And when we send in our property taxes, we trust that the money is being allocated correctly according to levies voted on. Many of us wouldn’t consider ourselves finance or tax gurus, however most of us are keenly aware that over half of our rising property taxes go to fund public schools (57%, in fact, according to kingcounty.gov).

So, when a parent comes across a document that states our school district was fined over $1.5 million tax dollars in IRS penalties due to negligence of its Assistant Superintendent/Finance Director Lori Cloud, it raises some serious concerns.

What were the circumstances?

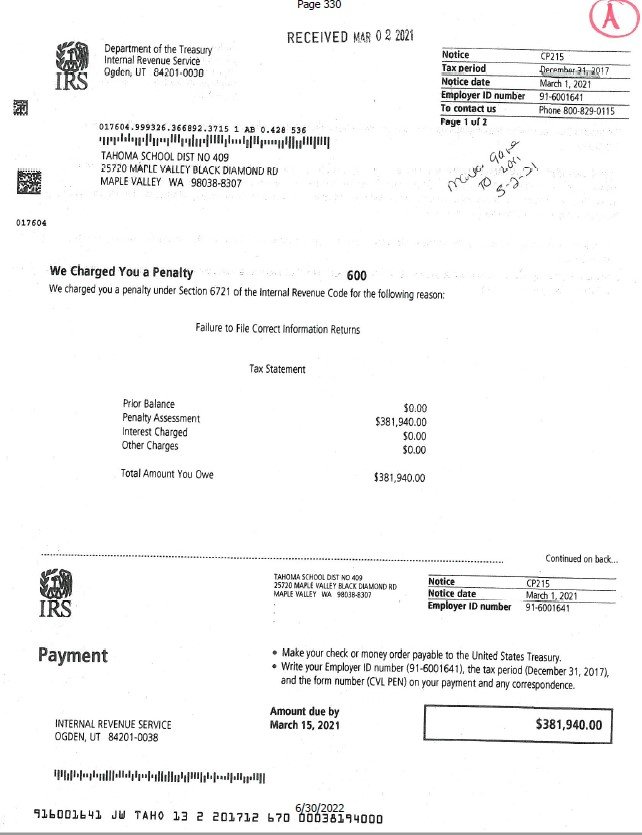

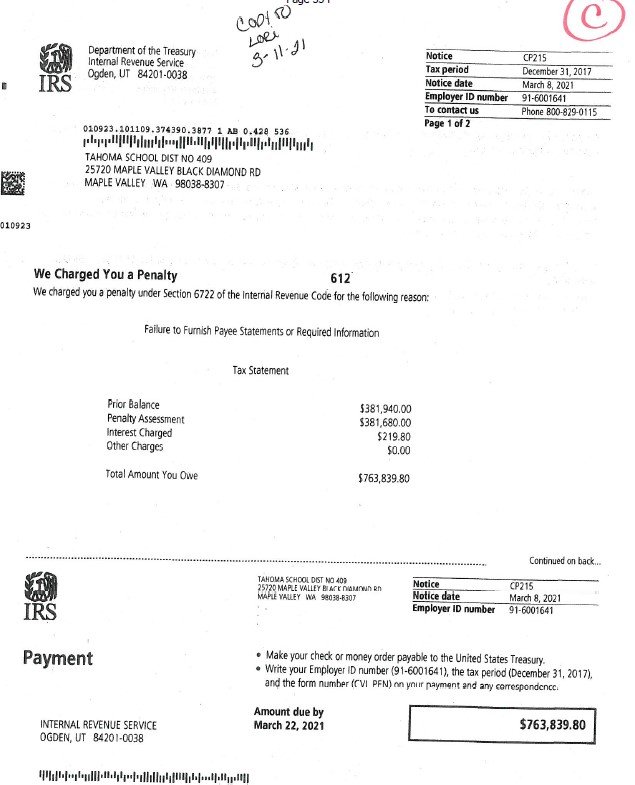

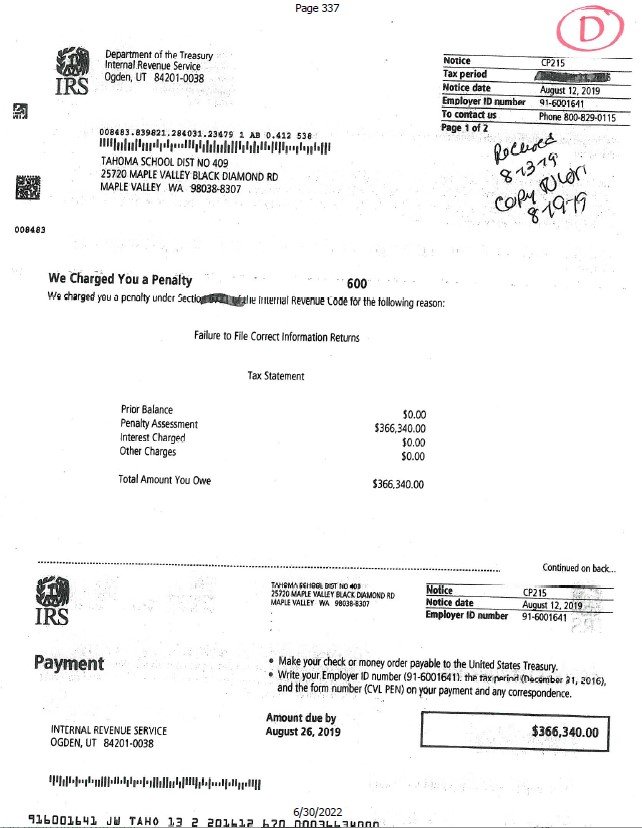

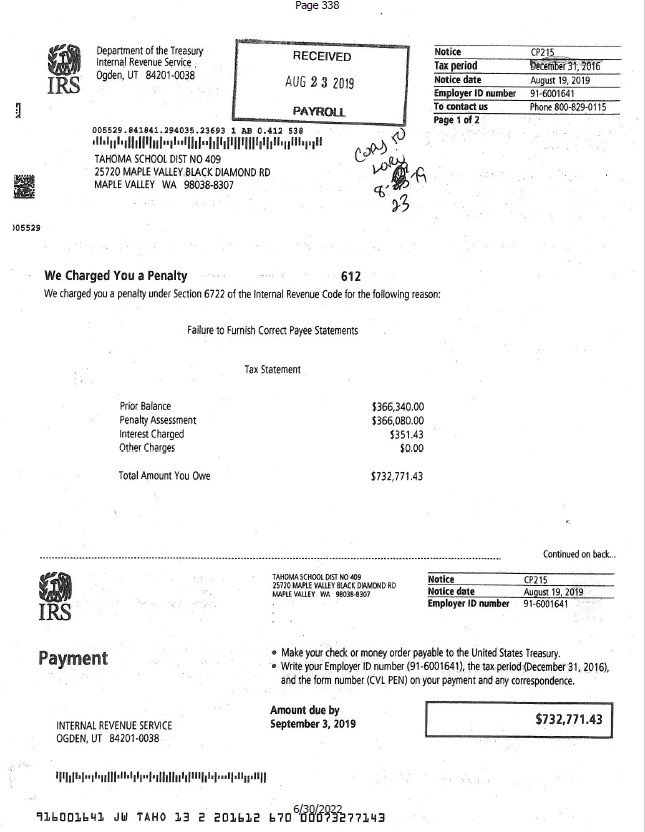

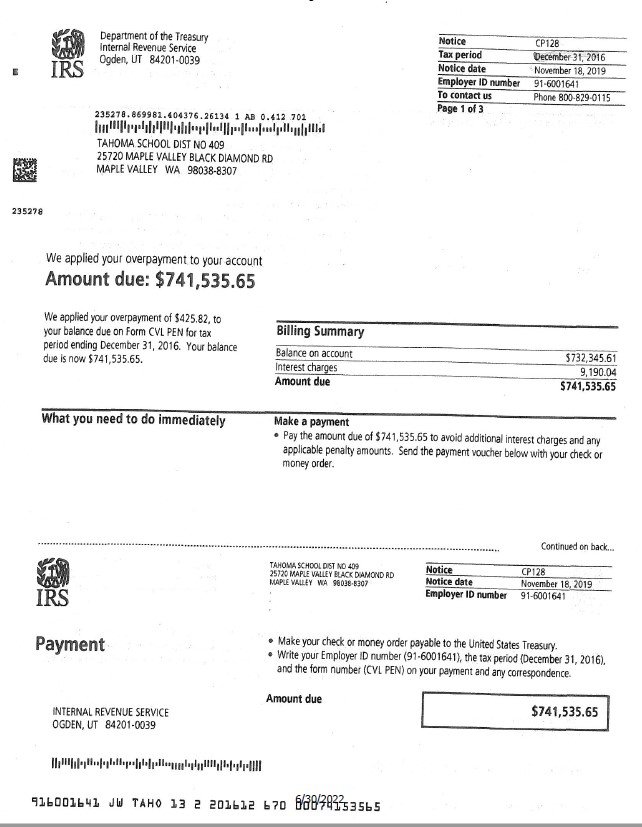

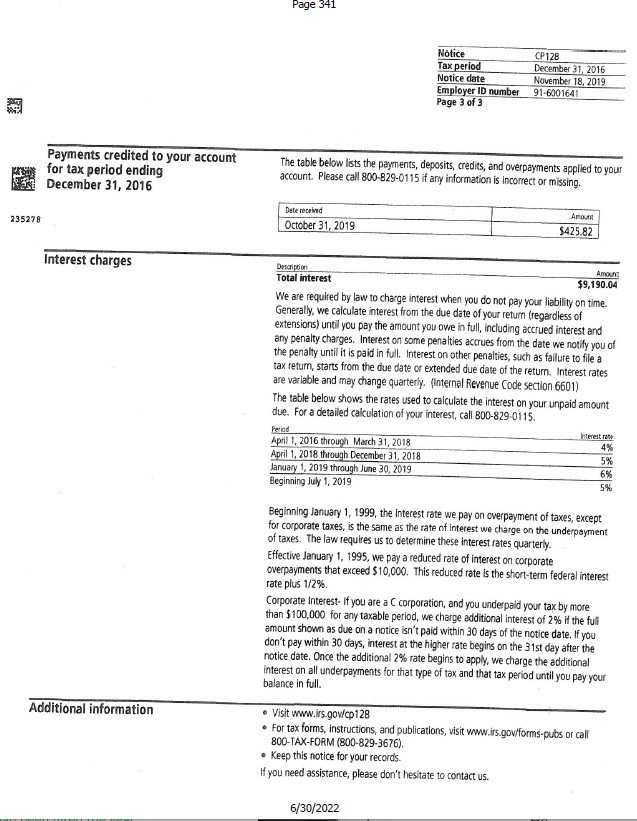

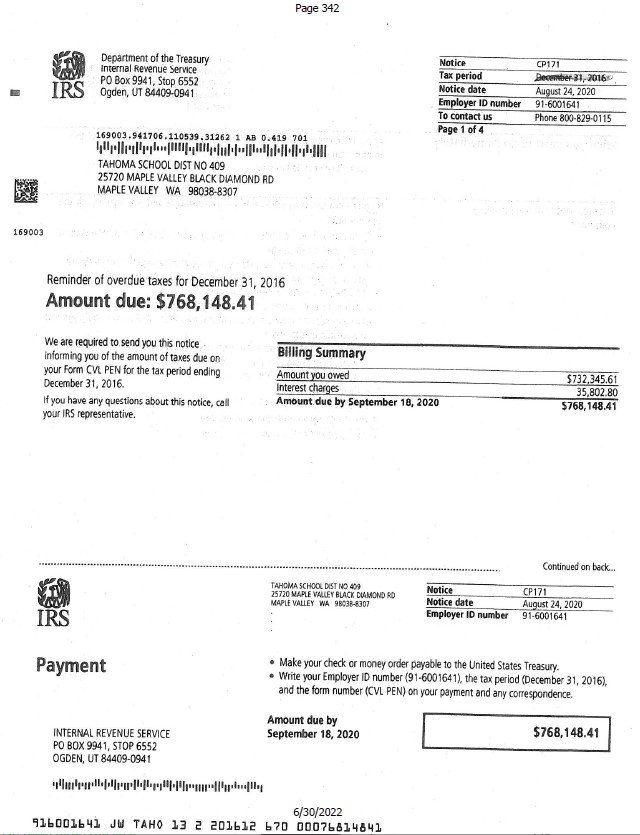

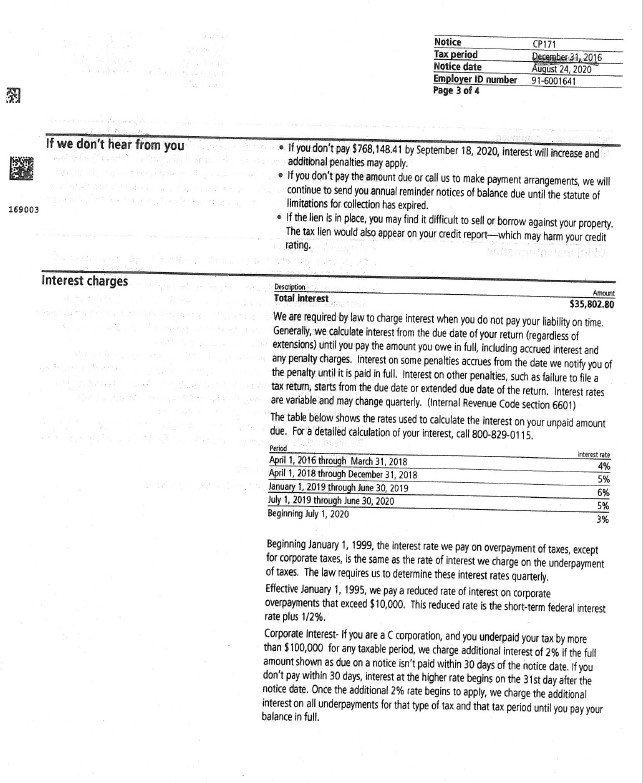

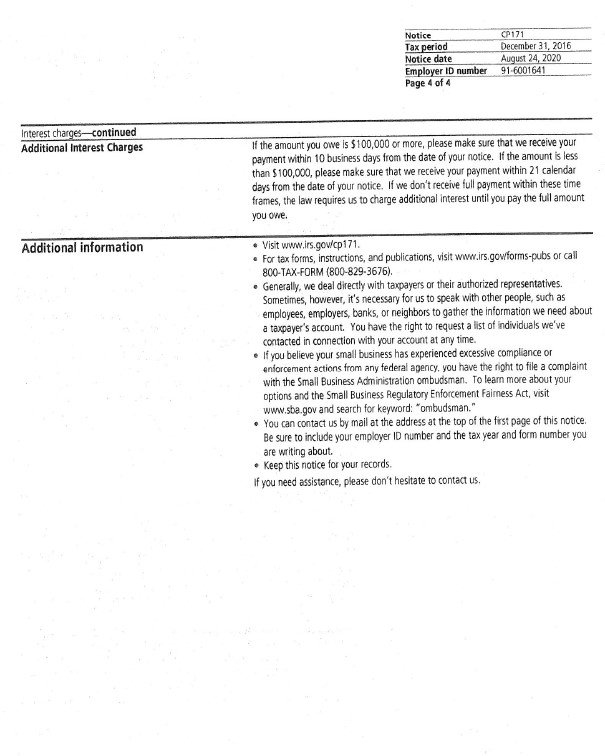

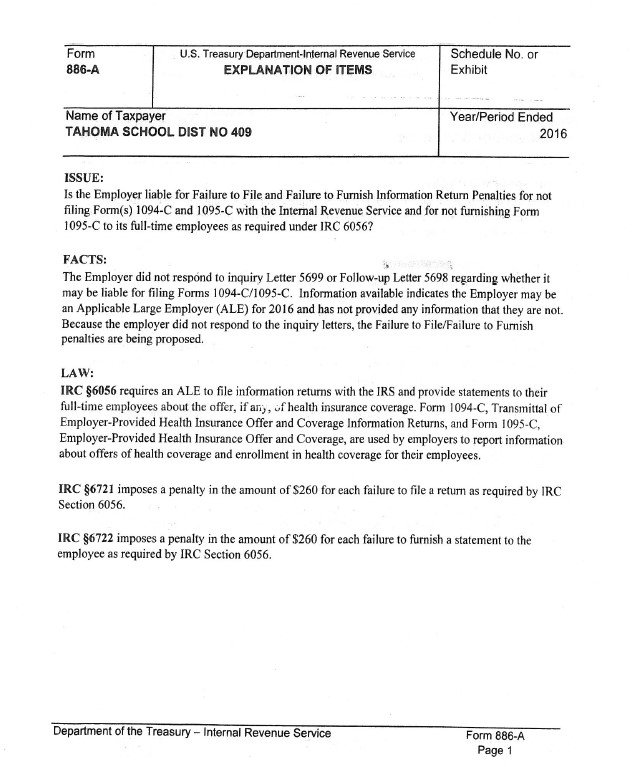

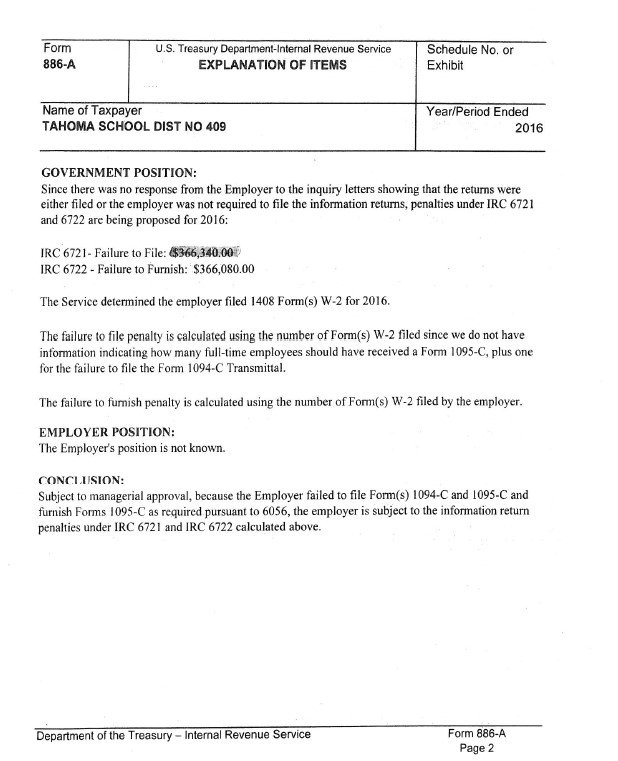

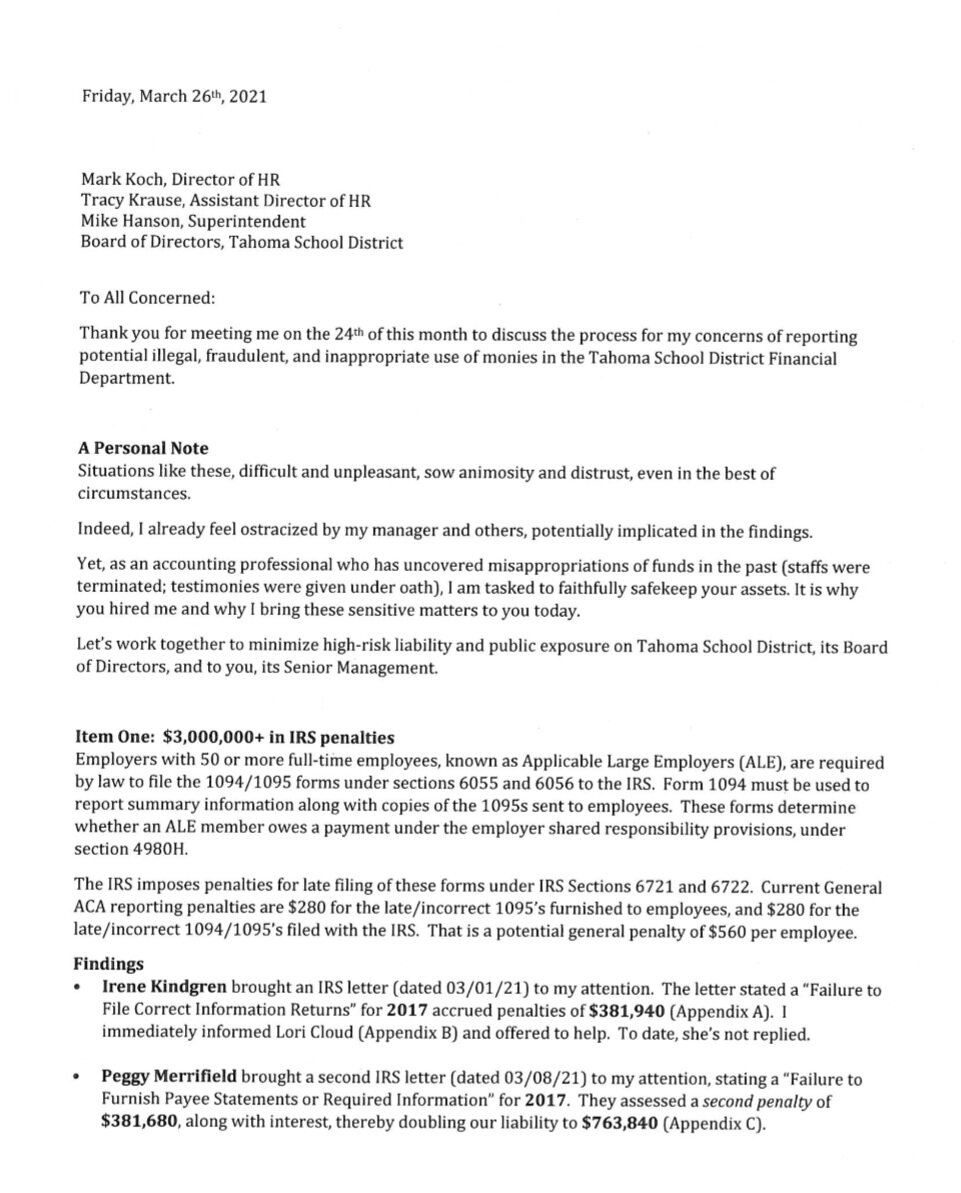

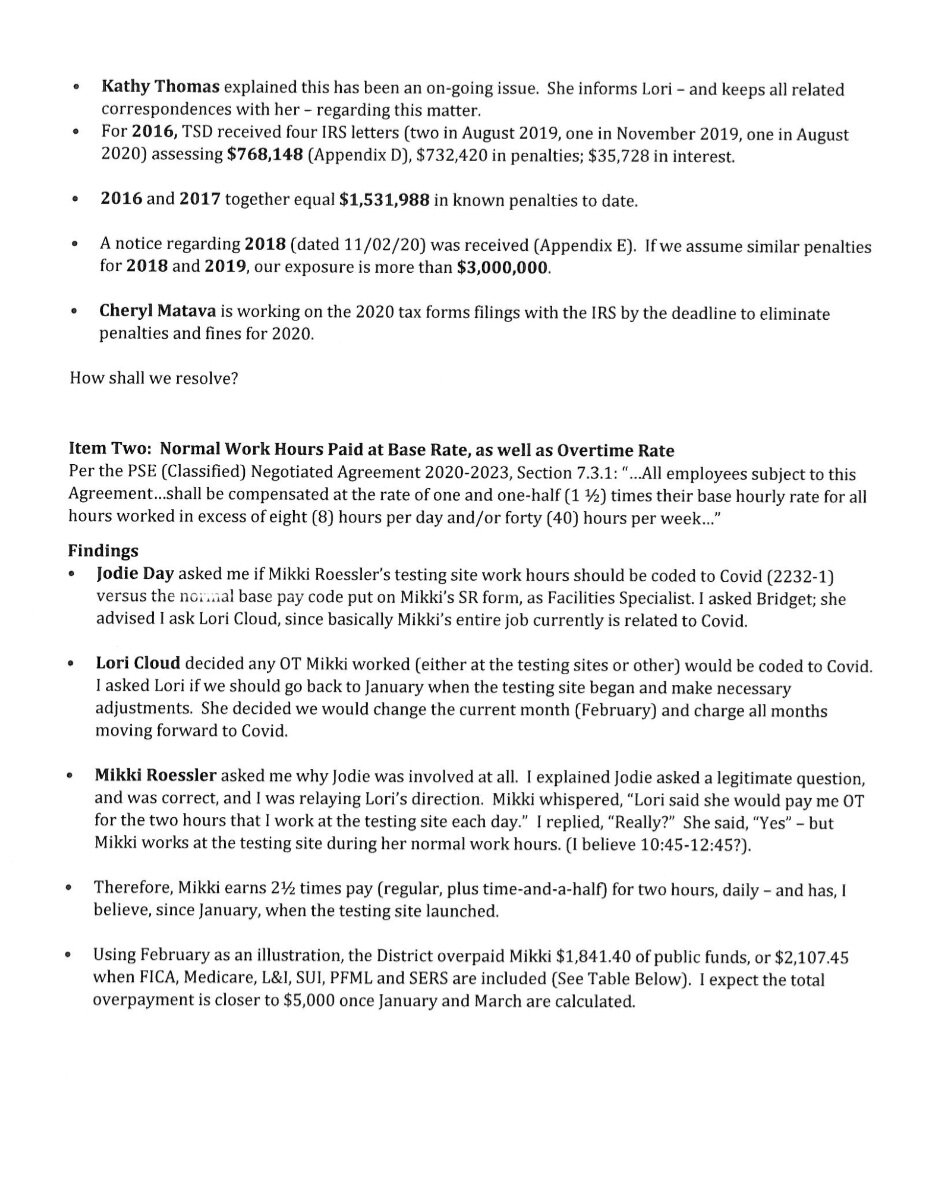

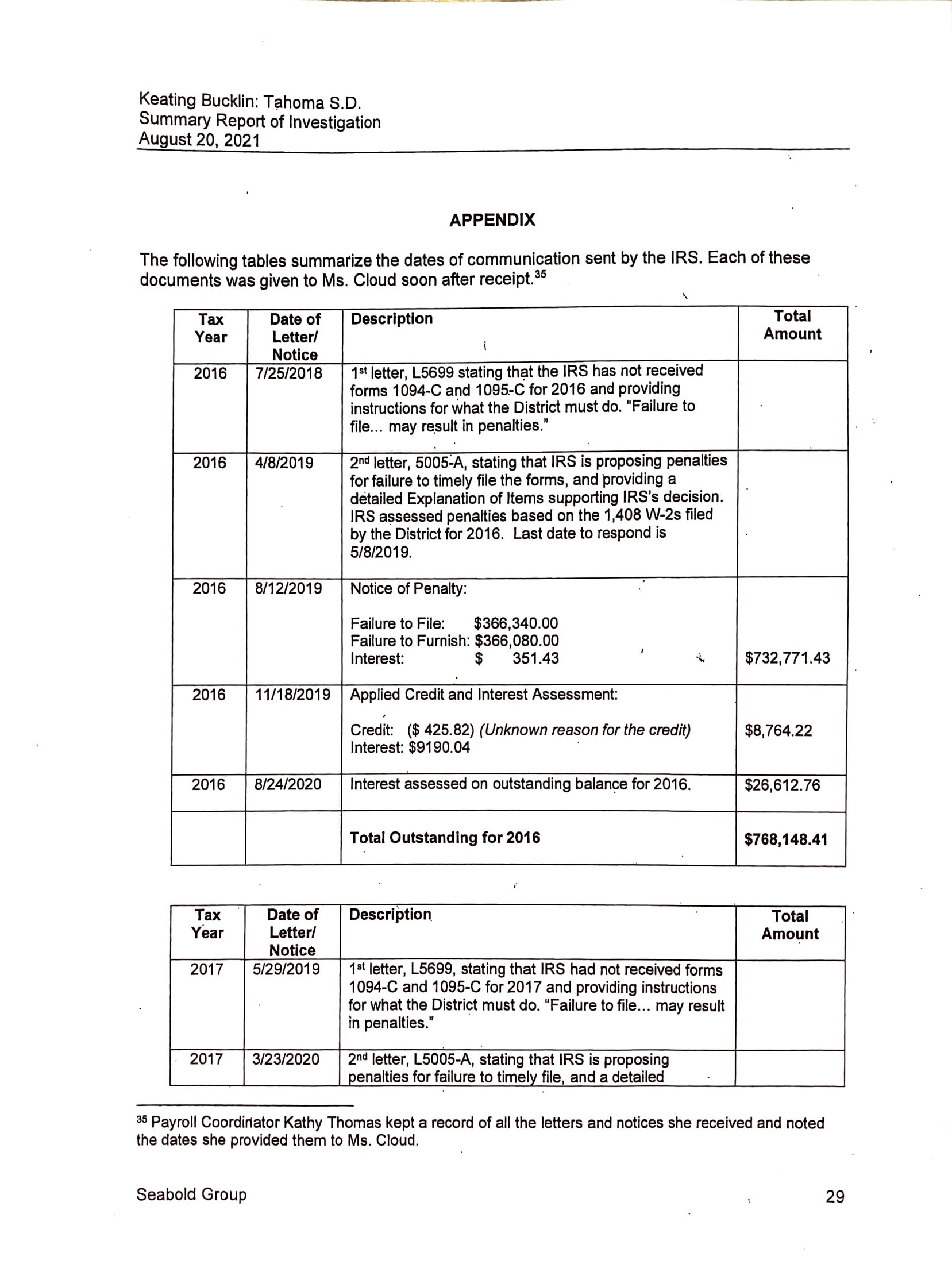

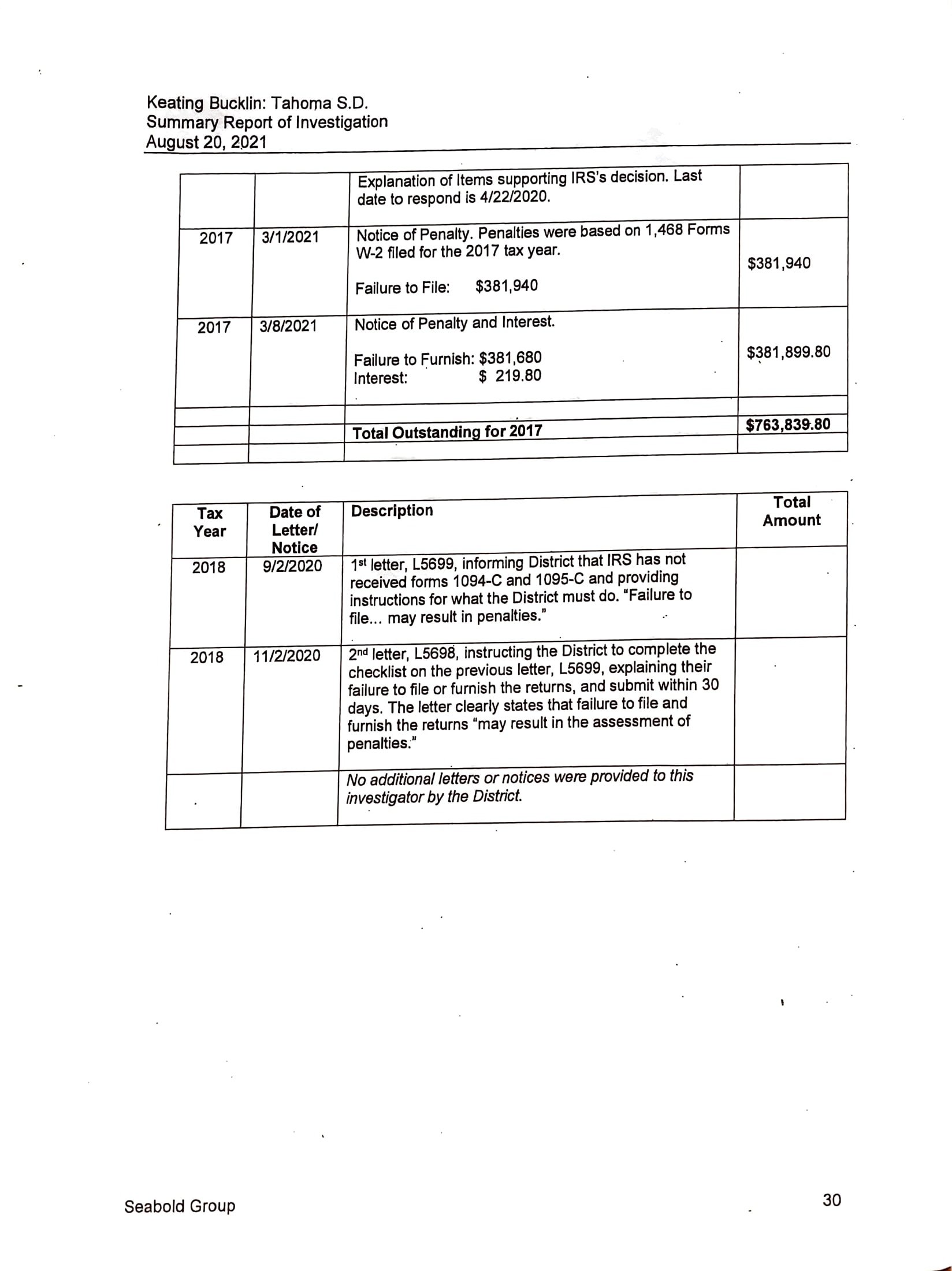

It was brought to the attention of Tahoma Parents that between the years of 2016 and 2017, the Tahoma School District was fined $1.5 million due to a failure to file informational returns 1094-C and 1095-C.

Use arrows or click icons to scroll through images

Employers with 50 or more full-time employees, including public school districts, are required by law to file these forms, which provide information to the employees and IRS regarding any employer-provided health insurance as part of the Affordable Care Act.

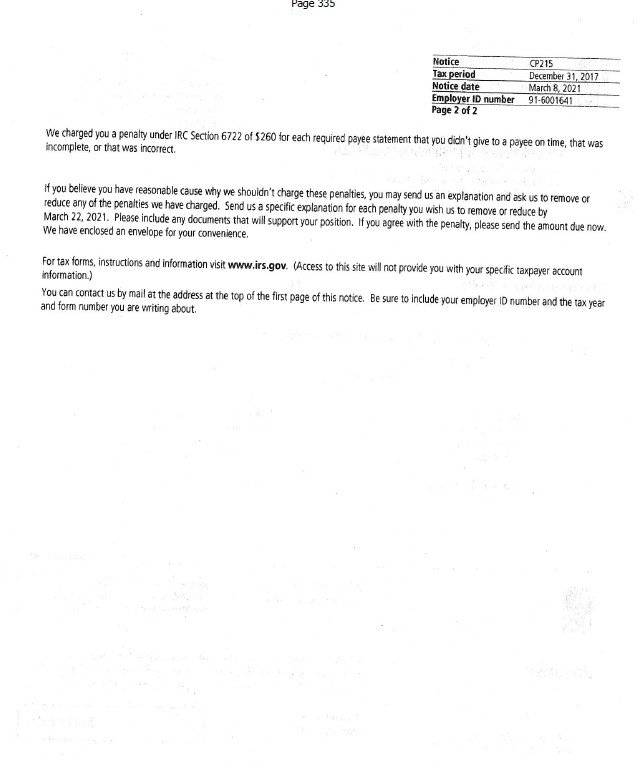

While the returns are informational only, the IRS may assess a significant penalty if they are not furnished to employees and also submitted to the IRS before the deadline. The potential penalty is $560 per employee per year.

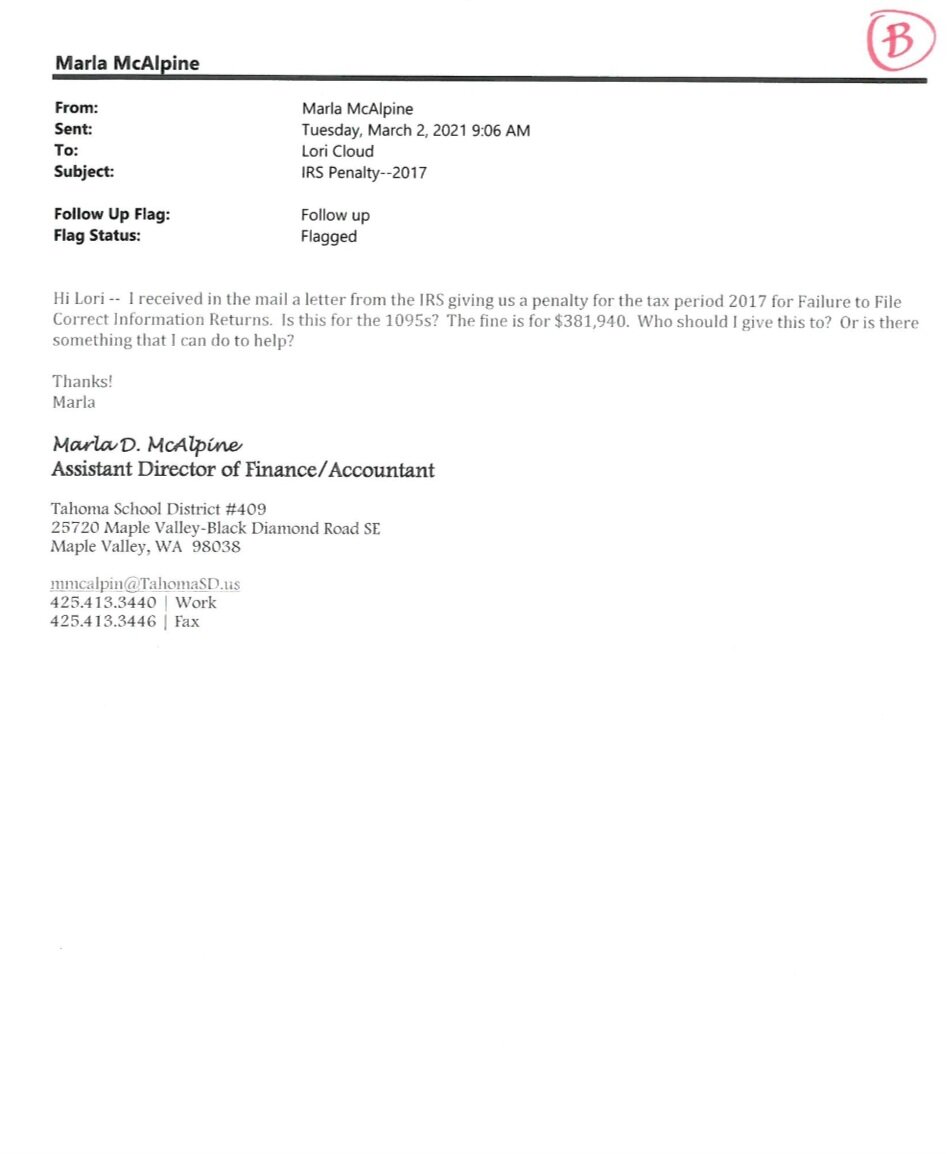

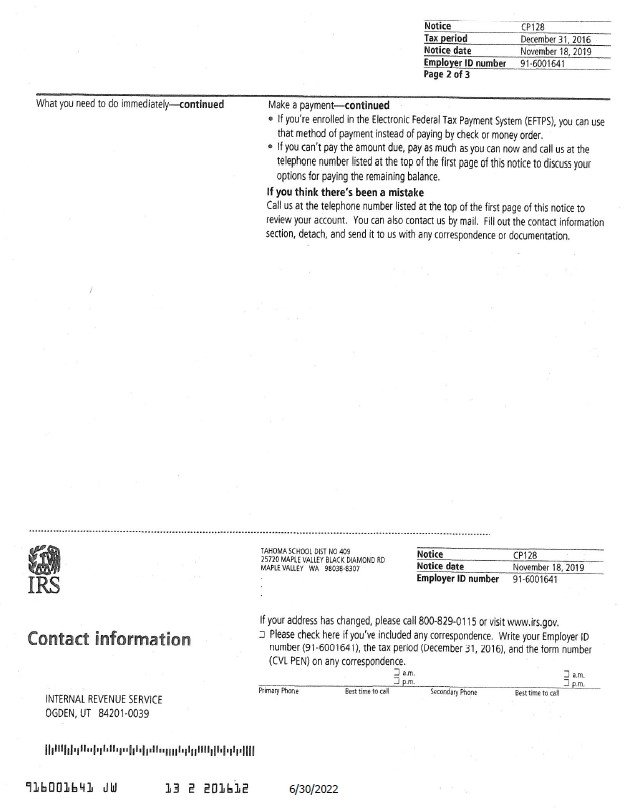

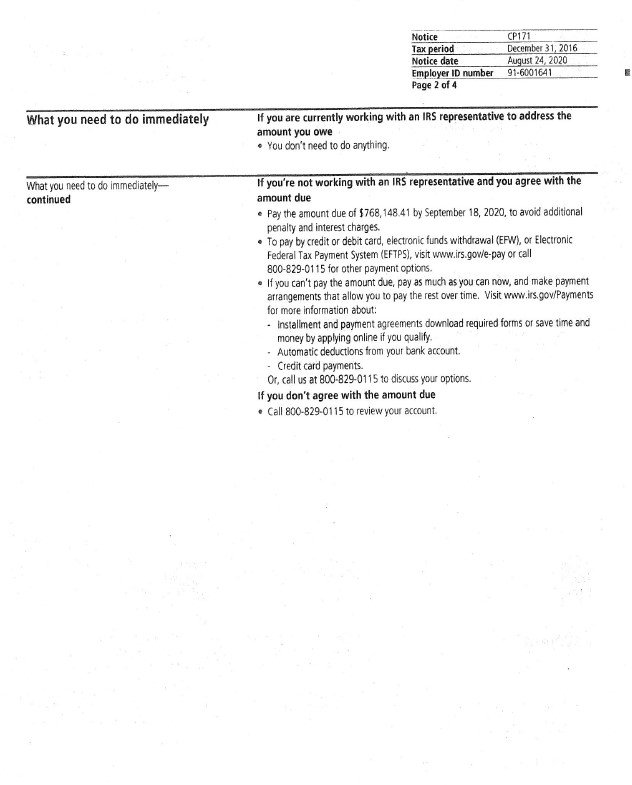

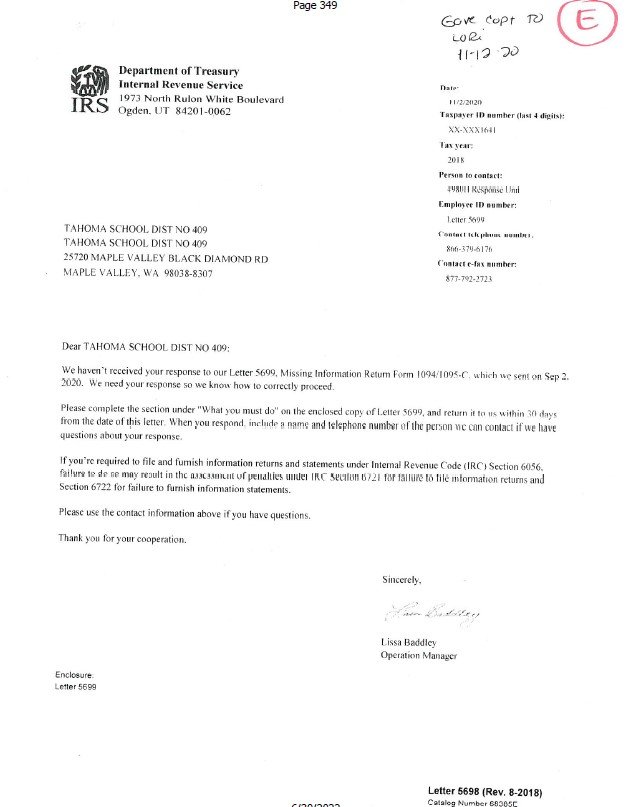

The District did indeed furnish the forms to each of its employees, but the companion returns were never filed with the IRS despite receiving many warning letters. Superintendent Mike Hanson and the Human Resources (HR) department did not become aware of the delinquencies until a whistleblowing employee filed a formal complaint against Ms. Cloud. The complaint came as the penalties and interest charged to the District exceeded $1.5 million with additional IRS warnings stating that penalties for 2018 might also be assessed (increasing potential fines to upwards of $3 million).

How did this happen? Where is the transparency?

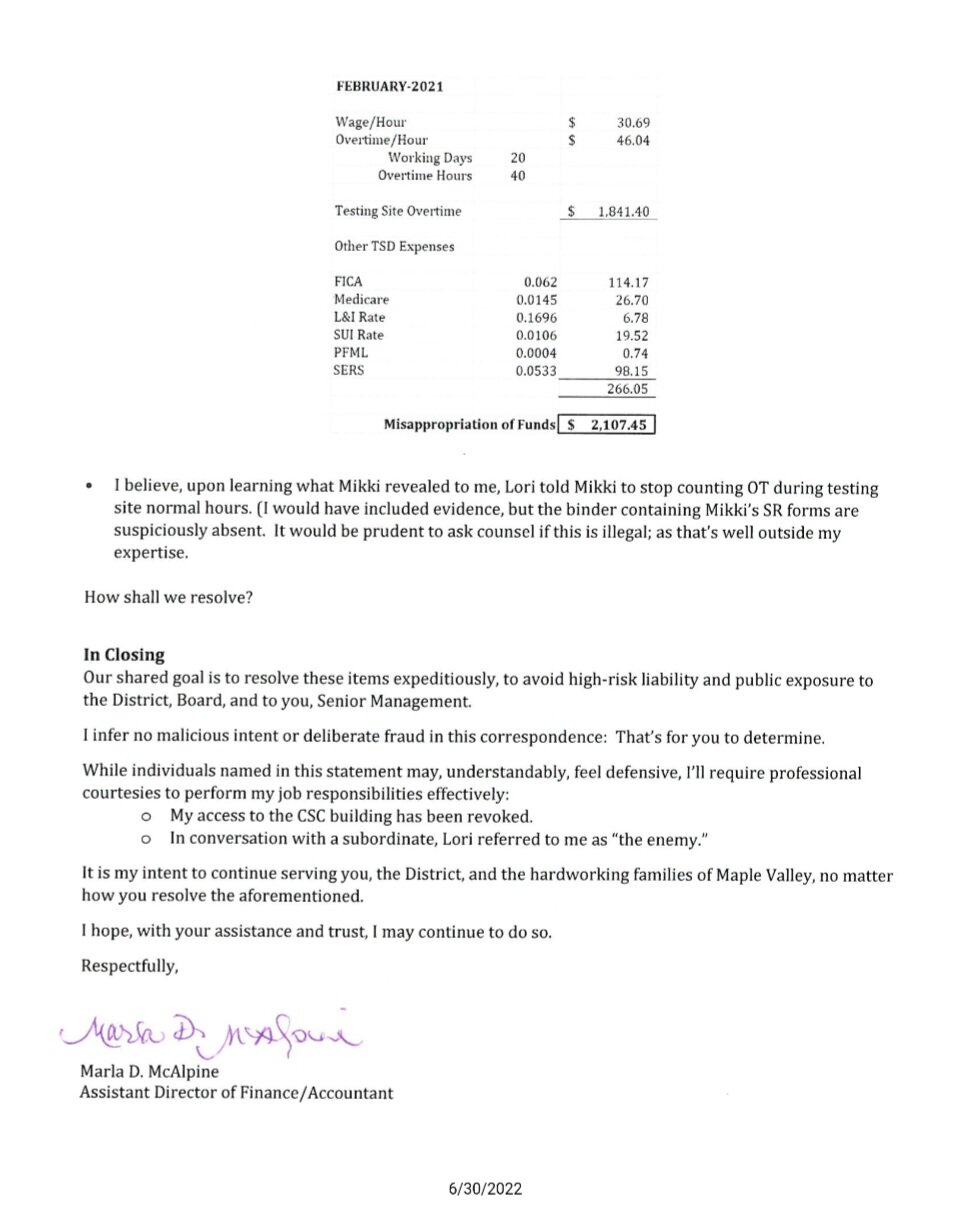

According to an independent investigation paid for by the school district:

Ms. Cloud failed to obtain a transmitter control code (or TCC, which is required by the IRS to electronically file the returns) even knowing that her failure to do so would, and did, ultimately result in substantial penalties against the District…In 2016 and 2017, the Payroll Coordinator reminded Ms. Cloud on at least nine occasions to apply for her TCC so she could file the returns….Ms. Cloud received 11 letters and notices of penalty and two detailed explanations supporting the IRS’s decision to asses penalties. After each letter and notice, she told the Payroll Coordinator that she would take care of it. But for several years and after each of the letters and notices, Ms. Cloud failed to obtain the code and continued to ignore the impact failing to file the returns would have (and was having) on the District.

Ms. Cloud provided several unpersuasive explanations for her failure to obtain the TCC necessary for the District to file: the IRS asked too many personal questions in the application process; she was waiting for changes to be made to her contract relating to the carry-over of vacation; she encountered technical problems (for over five years) and could not get help from the IRS.

Ms. Cloud also at one point told the investigator that the forms were mailed to the IRS before knowing they were required to file electronically. However, through early 2021, no required forms were ever filed with the IRS.

Finally, Ms. Cloud acknowledged that she just didn’t know why she didn’t obtain the TCC or direct another staff member to take on the task or make it a priority. The investigation report cited that no other staff member had any difficulties applying for and obtaining a TCC.

According to the independent investigation:

In one conversation, Ms. Cloud told the Benefits Specialist that her work on the 1095-Cs was a ‘waste of time.’ In another, she indicated to the Benefits Specialist that the 1095-Cs weren’t important, and she didn’t need to file them.

It is unknown why other staff members who were aware of the delinquencies and penalties (and of Ms. Cloud’s failure to address them) did not report the problem to the Superintendent, Human Resources, or the Board of Directors for those several years.

It wasn’t until early 2021 that newly-selected Superintendent Mike Hanson was made aware of the district’s IRS penalty situation when the formal complaint (posted above) was filed against Ms. Cloud by Marla McAlpine who had been hired the year prior with the understanding that she could be in position to earn Ms. Cloud’s role as Director of Finance when Ms. Cloud retired in a few years.

Retaliation Begins

Per the investigation:

Evidence establishes that…Ms. Cloud restricted Ms. McAlpine’s access to the building in direct response to learning of Ms. McAlpine’s complaint against her regarding Ms. Cloud’s failure to file the IRS returns. It also establishes that Ms. Cloud did so in an effort to block Ms. McAlpine from gathering additional documentation that would support her claims against Ms. Cloud, including potential fraudulent overtime given to another employee.

She had always had complete access to…the building, and that was taken away because of her investigation and complaint….Ms. Cloud did not restrict any other employee’s access to the building.

In conversations with other employees, it was revealed that Ms. Cloud referred to Ms. McAlpine as “the enemy” (as evidenced in the formal complaint above).

School Board Involvement

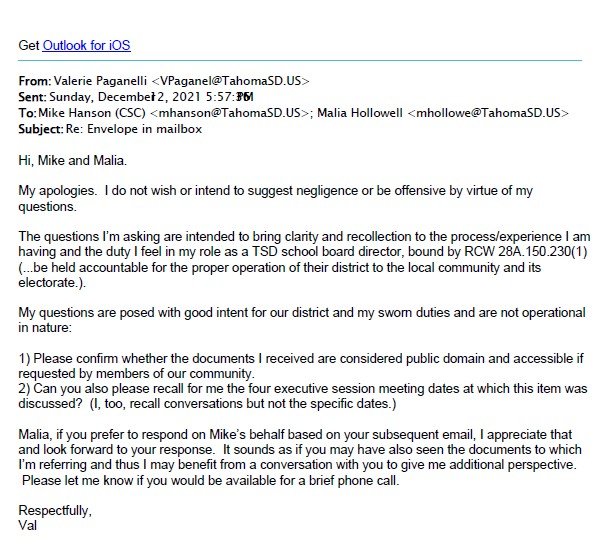

According to district emails (obtained from public records requests), Superintendent Hanson mentioned that the seriousness of the content, the complaint, the report, communication with attorneys and the IRS, and recommendations on how to proceed were discussed at several executive sessions and that the situation had been sufficiently resolved. However, the Board make-up changed with the resignation of Board President Katrina Montgomery and the subsequent appointment of Michael Wiggins to the Board before the findings of the investigation were released to at least one other Board Director that asked for the investigator’s document.

Per Board Policy 1221: If a Board Director requests records, documents or submits questions for information, the Superintendent will provide copies to all Board Directors.

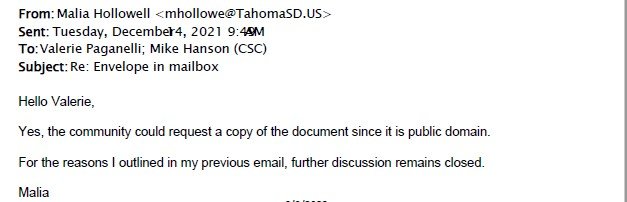

Valerie Paganelli, one of five School Board Directors at the time, believed the District was vulnerable due to inconsistencies with transparency and report accessibility within the community. To mitigate risk, Director Paganelli requested that further discussion be had with the full Board, which by then also included newly-elected member Haley Pendergraft. The President of the School Board (Malia Hollowell) would not reopen the conversation with the new and existing board members. She did however state, “Yes, the community could request a copy of the document [presumed investigation report] since it is public domain.”

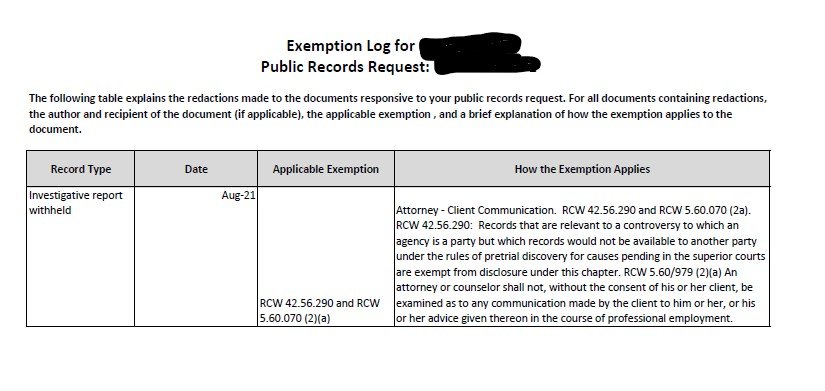

When Tahoma Parents requested the known and referenced investigation report from the TSD via a public records request, it was withheld.

How did this all end?

In early 2021, another district employee (who has since left) finished filing all the delinquent IRS forms. Luckily all district penalties were deemed abated, but thousands of taxpayer dollars in legal and investigative fees to render the abatement and obtain independent facts about the issue were still spent.

In August of 2021, Marla McAlpine resigned from her position with the District citing “recent events and the on-going toxic culture and retaliation experienced due to whistleblower activities.”

Effective February 28th, 2022, Valerie Paganelli resigned from her newly-elected second-term position as Board Director citing: “…maintaining my personal integrity has grown too heavy and the silencing of my inquiry and voice too deep…”

Lori Cloud remains the Assistant Superintendent/Finance Director of the Tahoma School District.

UPDATE 11/22/2022:

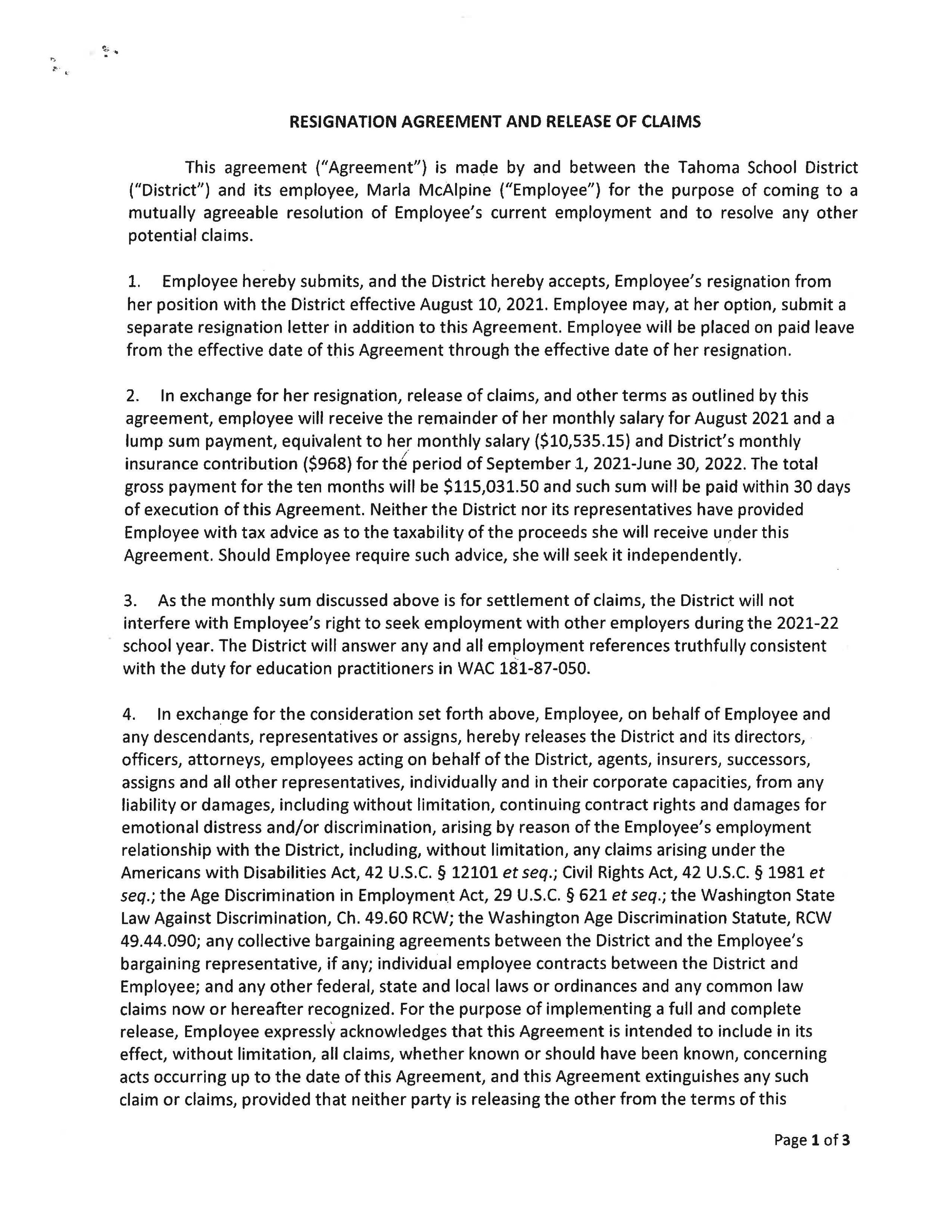

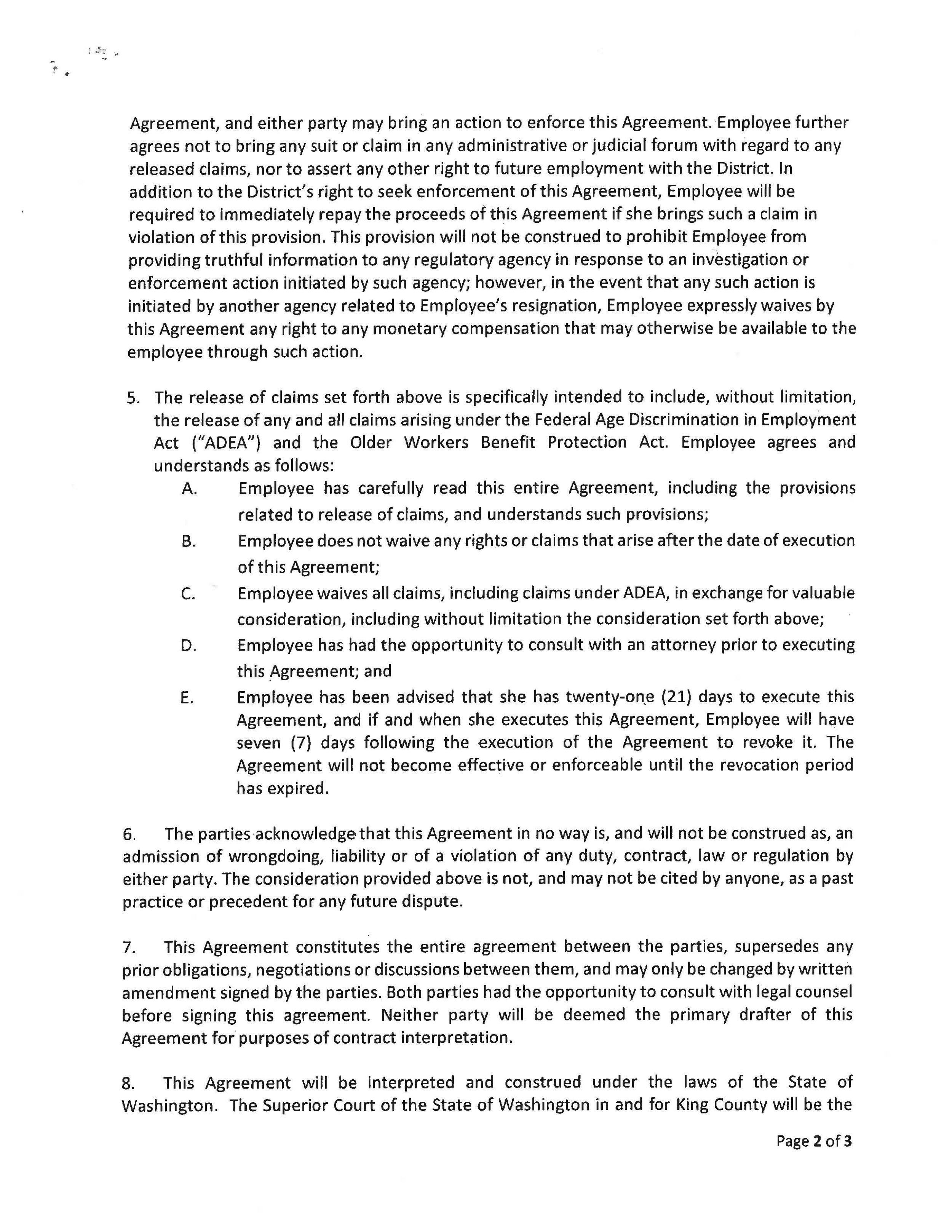

According to recently obtained documents, the TSD agreed to pay Marla McAlpine $115,031.50 over the course of 10 months for her resignation. The agreement appears to release the district from further damages related to Ms. McAlpine’s treatment.

Questions Remain…

WHERE is the integrity and accountability among those that handle the school district finances, especially as we prepare for future District levies?

HOW can we trust that we have a sustainable education system for the community if there are questions of whether it’s built on a solid governance foundation with appropriate checks and balances?

And WHY is negligence, dishonesty, and retaliatory behavior by those at the helm allowed to prevail?